Working capital is the difference between the present assets of a business and its present liabilities. It means the money available to cover the business’s short-term operational duties like paying suppliers employees and creditors. The process of organizing, managing, and keeping an eye on the working capital of a business with the goal of maximizing productivity and profitability is known as working capital management.

Since working capital management affects a company’s liquidity, profitability, solvency, and growth, it is an important aspect of financial management. In this article, we will discuss the main objectives techniques benefits and challenges of working capital management.

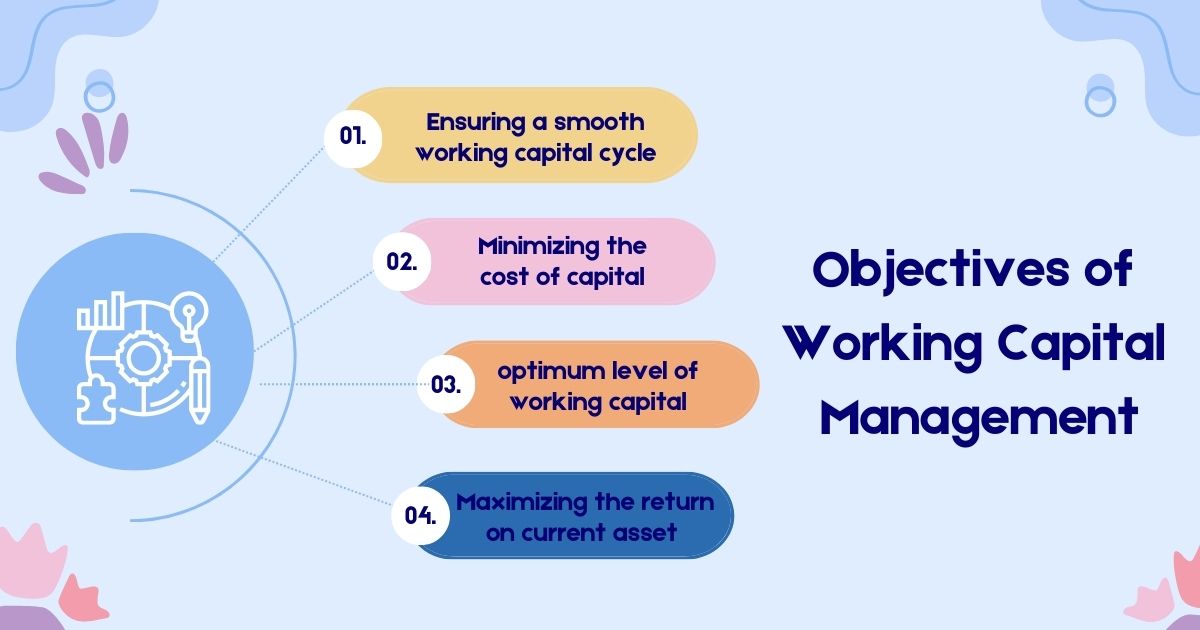

Objectives of Working Capital Management

The main objectives of working capital management are:

1. Ensuring a smooth working capital cycle: The working capital cycle is the time period between the payment for the purchase of raw materials and the collection of cash from the sale of finished goods. A seamless working capital process indicates that businesses can create cash quickly and successfully use it to meet requirements and invest in new opportunities. An effortless working capital procedure lowers the risk of bankruptcy and raises the creditworthiness of the company.

2. Maintaining an optimum level of working capital: The optimum level of working capital is the balance between the current assets and current liabilities that maximizes the return on investment and minimizes the cost of capital. A company with insufficient working capital has idle money that could be invested somewhere else to generate better profits. If a business has insufficient operating capital it could experience liquidity issues and miss out on lucrative prospects. In order to meet its operating and financial demands business should maintain an ideal amount of working capital.

3. Minimizing the cost of capital: The cost of capital is the rate of return that the business has to pay to its sources of funds such as equity debt and trade credit. The revenue and valuation of business are impacted by cost of capital. Profitability and business valuation of the business will increase with a decreasing cost of capital. Businesses should use the most suitable and affordable funding sources to meet their working capital needs in order to lower their cost of capital.

4. Maximizing the return on current asset investment: The return on current asset investment is the ratio of the net income generated by the current assets to the total amount of current assets. A business’s ability to use its working capital profitably and efficiently increases with the return on investment in current assets. Therefore the business should maximize the return on current asset investment by investing in the most profitable and productive current assets such as inventory receivables and cash.

Techniques of Working Capital Management

The various techniques of working capital management are:

1.Cash management: Cash management is the process of managing the cash inflows and outflows of the business to ensure that it has sufficient cash to meet its obligations and to take advantage of profitable opportunities. Cash management involves forecasting the cash flows preparing the cash budget controlling the cash receipts and payments and investing the surplus cash in short-term securities or deposits.

2. Inventory management: Inventory management is the process of managing the quantity quality and cost of the raw materials work-in-progress and finished goods of the business to ensure that it meets the demand of the customers and avoids wastage and obsolescence. Inventory management involves determining the optimal inventory level ordering policy reorder point safety stock and inventory turnover ratio.

3. Receivables management: Receivables management is the process of managing the credit sales and collections of the business to ensure that it maximizes the sales revenue and minimizes the bad debts and collection costs. Receivables management involves setting the credit policy credit terms credit limit and collection policy.

4. Payables management: Payables management is the process of managing the purchases and payments of the business to ensure that it takes advantage of the trade credit and discounts offered by the suppliers and avoids penalties and interest charges. Payables management involves negotiating the credit terms payment terms and discount terms with the suppliers and scheduling the payments accordingly.

5. Working capital financing: Working capital financing is the process of raising the funds required to meet the working capital needs of the business from various sources such as equity debt trade credit and bank overdraft. Working capital financing involves choosing the most suitable and cost-effective source of funds considering the risk return and maturity of the funds. Read: Types of Working Capital

Benefits of Working Capital Management

The benefits of working capital management are:

- Improving liquidity: Liquidity is the ability of the business to pay its current obligations as and when they become due. By ensuring that the business has enough cash and other current assets to cover its current liabilities as well as any unexpected emergencies working capital management helps the company’s liquidity.

- Improving profitability: Profitability is the ability of the business to generate income from its operations and investments. By lowering the cost of capital, raising the return on current asset investment and maximizing the working capital cycle, working capital management raises the profitability of a business.

- Improving solvency: Solvency is the ability of the business to pay its long-term obligations and to survive in the long run. By lowering financial risk and leverage, increasing liquidity, profitability, creditworthiness and managing working capital a business can become financially stable.

- Improving growth: Growth is the ability of the business to expand its operations and market share. By giving the company enough money to invest in new initiatives, products, and markets, along with enhancing its competitive advantage and customer satisfaction, working capital management helps the company grow. Apply Now for Working capital loan

Challenges of Working Capital Management

The challenges of working capital management are:

Uncertainty: Uncertainty is the lack of knowledge or information about the future events and outcomes that may affect the working capital of the business. Uncertainty may arise due to various factors such as changes in the demand supply price technology competition regulation and macroeconomic environment. Uncertainty makes it difficult for the business to forecast and plan its working capital needs and to adjust its working capital policies accordingly.

Trade-off: Trade-off is the conflict or compromise between the competing objectives and constraints of the working capital management. Trade-off may occur due to various factors such as the trade-off between liquidity and profitability the trade-off between risk and return and the trade-off between short-term and long-term goals. Trade-off makes it challenging for the business to balance its working capital needs and to achieve its optimal working capital level.

Coordination: Coordination is the integration and alignment of the various activities and functions of the working capital management. Coordination may involve various aspects such as the coordination between the different departments and units of the business the coordination between the different sources and uses of funds and the coordination between the different techniques and policies of the working capital management. Coordination requires effective communication collaboration and control among the various stakeholders of the working capital management.

Risk: Risk is the possibility or probability of loss or failure due to the uncertainty and variability of the working capital of the business. Risk may arise due to various factors such as the risk of insolvency the risk of default the risk of interest rate the risk of exchange rate and the risk of inflation. Risk requires careful assessment measurement and mitigation by the business to ensure its working capital security and stability. Check working capital emi calculator

Conclusion

A key element of financial management that influences the productivity and prosperity of a business is working capital management. Ensuring a smooth working capital cycle, maintaining an ideal level of working capital, minimizing the cost of capital and optimizing the return on current asset investment are the primary goals of working capital management.

The various techniques of working capital management are cash management inventory management receivables management payables management and working capital financing. The benefits of working capital management are improving liquidity profitability solvency and growth of the business.

The challenges of working capital management are uncertainty trade-off coordination and risk. To overcome these challenges the business should adopt a flexible and dynamic approach to working capital management that suits its nature size and goals.

FAQs

Q.1 What are the main objectives of working capital management?

The primary objectives include ensuring a smooth working capital cycle, maintaining an optimum level of working capital, minimizing the cost of capital, and maximizing the return on current asset investment.

Q.2 .How does working capital management impact a company’s financial health?

Working capital management affects liquidity, profitability, solvency, and growth, making it a vital aspect of financial management.

Q.3 What techniques are employed in working capital management?

Techniques include cash management, inventory management, receivables management, payables management, and working capital financing.

Q.4 How does working capital management benefit businesses?

It improves liquidity, profitability, solvency, and growth by optimizing the use of resources and minimizing costs.